Tax monitoring

FinExpertiza was one of the first companies on the Russian market to start implementation of tax monitoring at the largest enterprises of the country. We have gained considerable practical experience and established constructive cooperation with the Federal Tax Service, and leading companies from various industries have become our clients.

FinExpertiza specialists help businesses to comprehensively prepare for online interaction with tax authorities and are ready to provide full legal and technical support for the transition process.

Tax monitoring provides for opening by companies of access to their accounting systems for the Federal Tax Service online. As a result, the company is not reviewed and gets prompt explanations of the tax inspectorate on tax issues.

The specifics of tax monitoring

• Ongoing interaction with tax authorities in electronic form

• Disclosure of information on tax risks and internal control system to tax authorities

• Possibility to request a reasoned opinion of tax authorities on specific tax issues

As a pilot project, tax monitoring was launched in Russia in 2013, and was included in the Tax Code in 2016.

Tax monitoring allows a company to switch to remote interaction with the Federal Tax Service, avoid unexpected claims from the inspectorate and proactively manage tax risks. Business can forget about classical reviews and stop worrying about additional charges and fines, and it can also optimize costs.

• No tax reviews, both desk and onsite (control in online mode) (There are exceptions!)

• No fines or penalties

• Mitigation of tax risks, considerably higher level of certainty in relations with tax authorities and during tax planning

• Obtaining a substantiated opinion of tax authorities on taxation of any transactions, incl. planned ones

• "Prompt closing" of tax periods - by October 1 of the following year (no need to wait till an onsite tax review is completed)

Conditions for implementation of tax monitoring

• The amount of taxes charged to the company (VAT, MET, excise taxes, corporate income tax) for the prior year - at least 300 million rubles.

• The amount of the entity's income according to its financial statements for the prior year is at least 3 billion rubles.

• The total value of the entity's assets as of December 31 of the prior year is at least 3 billion rubles.

As of today, the Government is in the process of agreeing on a draft law, according to which, starting from 2022, it will be possible to switch to tax monitoring for companies with total tax deductions of at least 100 million rubles, the amount of income according to the financial statements for the prior year - at least 1 billion RUB, the total assets as of December 31 for the prior year - at least 1 billion RUB.

Goals of transition to tax monitoring:

• Management of an entity's tax risks

• Protection from tax reviews and fines

• Reduction of an entity's labor costs related to tax control

Means of implementation:

• Providing access to the accounting data mart or direct access to information systems of a company in real-time mode

• Obtaining a substantiated opinion of the inspectorate on tax issues and planned transactions

Expected results:

• Not tax claims, reviews or sanctions

• Reduced labor costs of support of tax control measures

• Higher stability of the business environment

Interaction with the Federal Tax Service within the framework of tax monitoring:

• Disclosure of information on financial performance and existing risks

• Information systems should ensure functioning of the internal control system (ICS)

• Provision of access to IT systems

• The number of submitted source documents depends on the level of organization of the ICS

The documents to be submitted to tax authorities to carry out tax monitoring:

• Application for tax monitoring

• Regulation of information interaction

• Information on the owners of the company, whose share is more than 25%

• Accounting policies for tax purposes

• Internal documents regulating the company's ICS

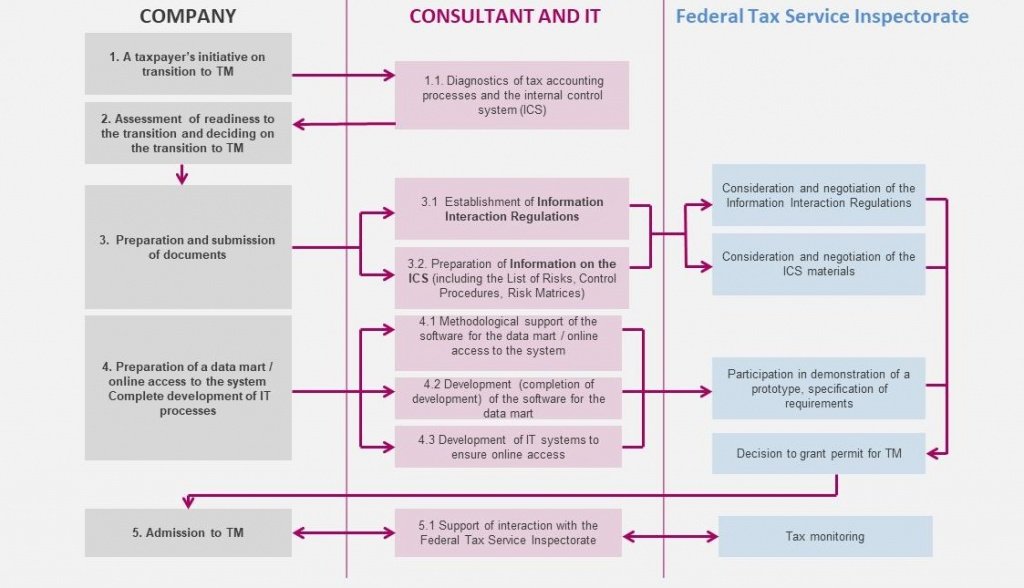

• Express diagnostics

• Preparation of a set of documents for transition to TM: Regulation of information interaction, information on CDR (with all attachments) - in accordance with the requirements of the Federal Tax Service

• Full automation of tax accounting and reporting: methodology and implementation in 1S

• Providing the tax authority with access to the data mart / online access to the accounting system

• Internal control system: development of documentation and automation of control procedures

• Consulting and support of the company at all stages of preparation for TM and after the TM is started

• Insufficient level of organization of the tax accounting system (lack of an approved album of tax registers, lack of approved algorithms for drawing up registers and filling out tax reporting forms)

• Insufficiently automated tax accounting system and tax reporting (lack of automated registers for certain accounting items, manual filling of some indicators of tax returns, lack of decryption of registers and tax returns to a source document)

• Insufficiently developed internal control system (ICS) and the risk management system (RMS)

• Lack of a system of linkages between tax registers and reporting forms (linkages of the following type: register - register; register - accounting data; register - tax return; tax return - tax return; tax return - accounting data; tax return - financial statements)

• Lack of an automated system of control procedures for taxes - the system of internal tax control (ITCS) (implemented in the form of control reports based on internal control documents: a list of risks, a set of control procedures, a matrix of risks and control procedures)

• Decisions on the organization and automation of the system of tax accounting and tax reporting, on the description and implementation of the internal control system (including the ITCS mechanisms) - are subject to statutory disclosure in the information interaction regulations, information on the ICS or in the form of annexes to these documents.

FinExpertiza conducts preliminary express diagnostics of the current state of tax accounting and the internal control system at enterprises in order to assess the possibility of transition to tax monitoring.

• Duration - one working day

• Methods - analysis of documentation, analysis of the accounting system, interviewing

• Free of charge

Based on the results of express diagnostics, a project plan is prepared with indication of deadlines and a budget, which will contain a list of necessary activities, including IT development.

FinExpertiza international audit and consulting network is the only Russian brand on the audit and consulting market that has won international recognition. FinExpertiza is a member of the Forum of Firms and is ranked among the best audit and consulting networks in the world according to The International Accounting Bulletin (IAB), World Tax & World Transfer Pricing.

Offices in 16 countries of the world. More than 1000 qualified experts.

FinExpertiza is trusted by the leading Russian companies: the clientele includes two thirds of companies ranked in the ТОP-50 of RAEX-600 rating.

Based on its own methodological developments, FinExpertiza offers solutions for transition to tax monitoring. Our experts support clients at all stages of transition to tax monitoring. We will develop a methodology, set up IT systems for your company and help organize interaction with the Federal Tax Service.

FinExpertiza guarantees reasonable and transparent pricing – results-oriented services and adequate prices with no hidden costs.

Вас также может заинтересовать

Наши клиенты